do you pay tax on a leased vehicle

However according to the article New Jersey allows a refund for a portion of this tax paid upfront if. New Jersey is another state that requires taxes to be paid upfront for long-term leases.

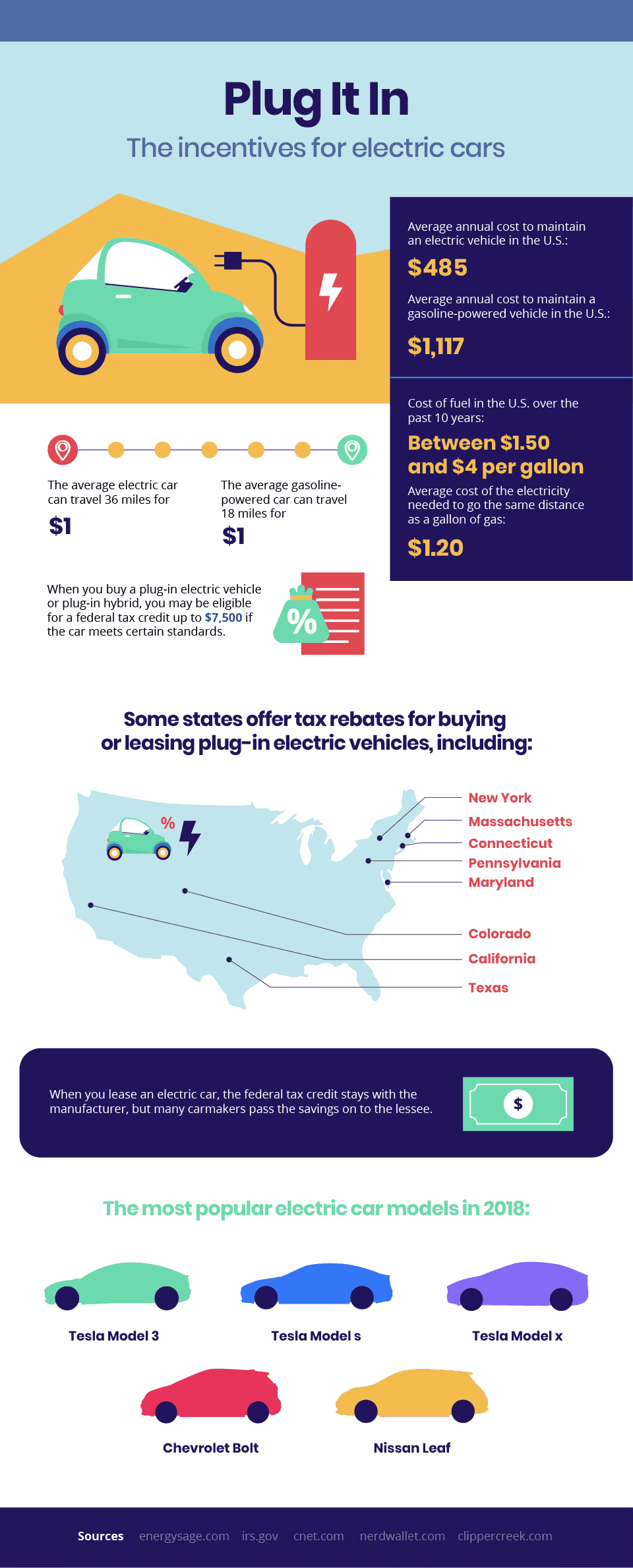

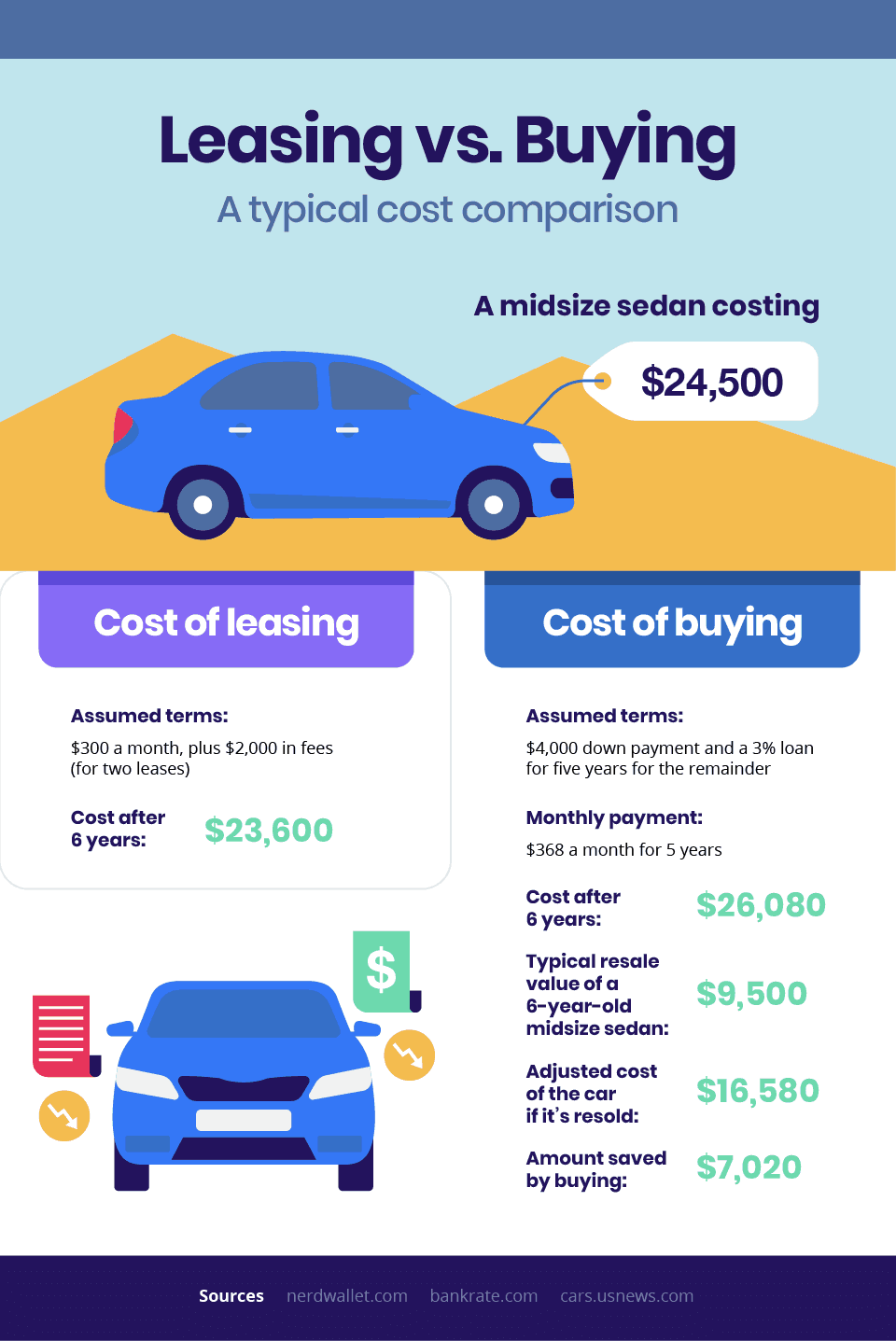

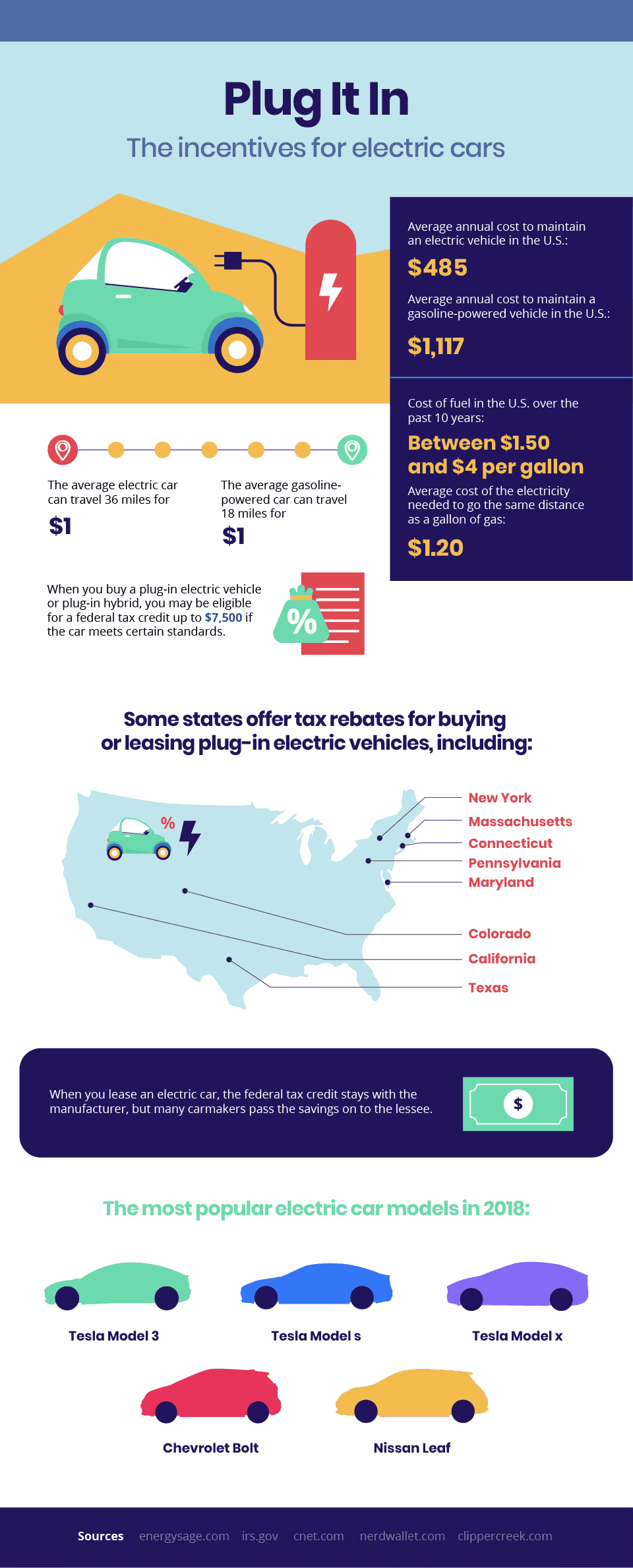

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

You may have pay taxes on a leased car depending on your state.

. A leasing agreement and state statutes govern when personal property taxes must be paid on your. Check the details with. No tax is due on the lease payments made by the lessee under a lease agreement.

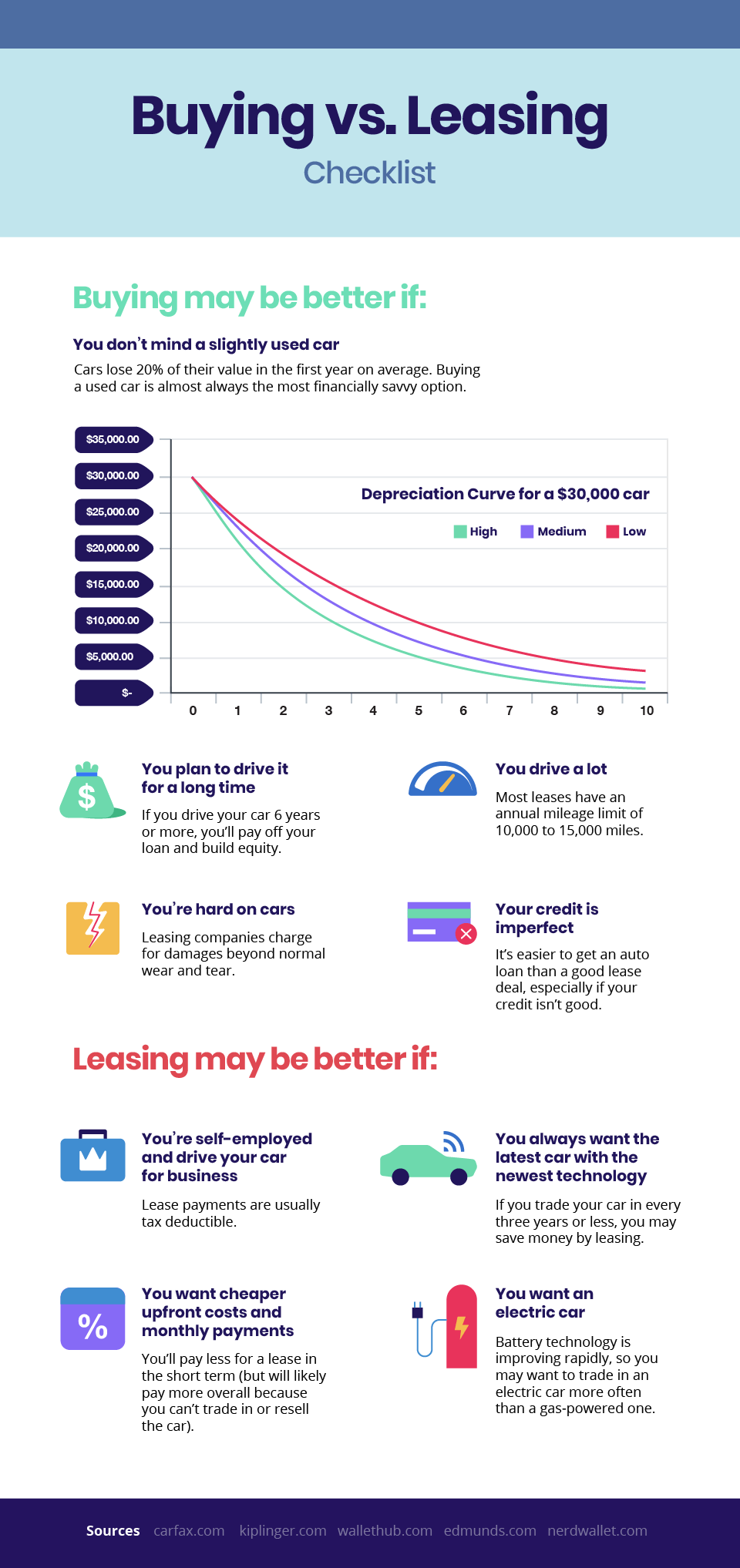

When you buy a car you pay sales tax on the total. If you pay personal property tax on a leased vehicle you can deduct that expense on your federal tax return. But you can use costs of operating a leased business car to reduce your federal tax bill.

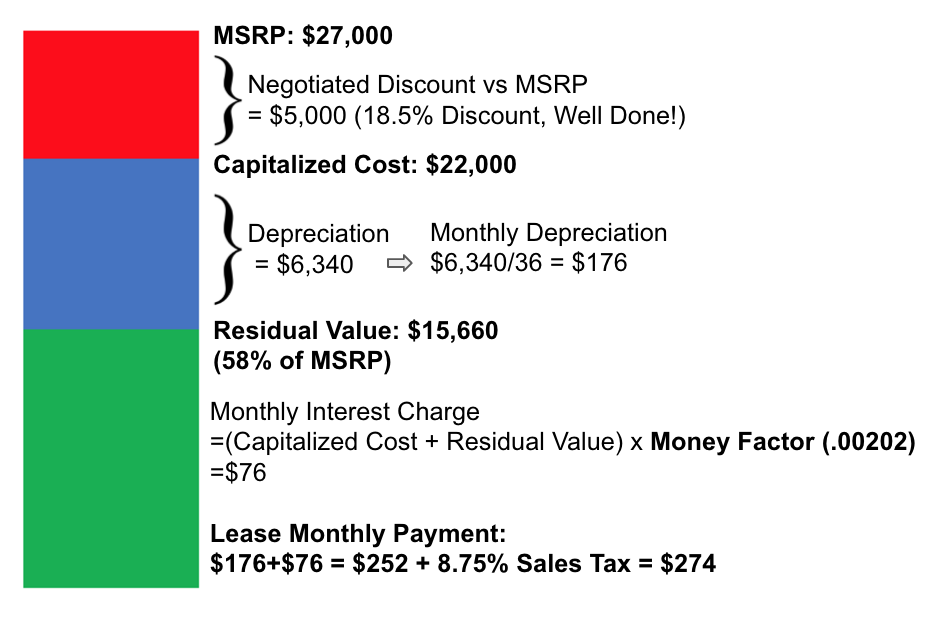

Taxes and Registration for Leasing a Car. The most common method is to tax monthly lease payments at the local sales tax rate. The monthly rental payments will include this additional cost which will be spread across your contract.

Titling Your Leased Vehicle. Use tax is due. In most states tax on a lease payment plan is based on taxing each monthly payment.

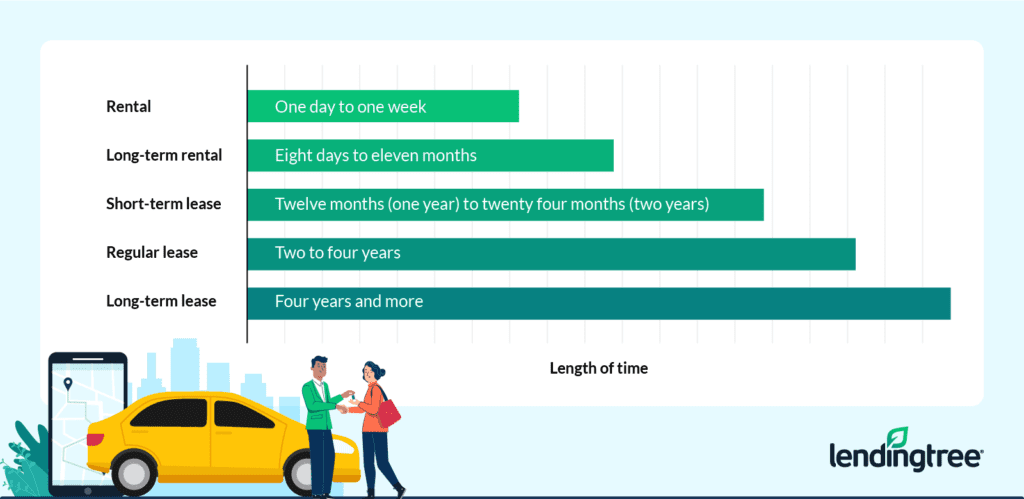

Sells the vehicle within 10 days use tax is due only. What you pay and when you pay varies. When you rent a car you can pay a small monthly usage tax on the rental depending on your national or local tax rate.

The Internal Revenue Service requires that these deductible ad. Any tax paid by the. States require you to pay a sales tax on a leased vehicle.

Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. In a handful of states lessees are responsible for paying sales tax on the full selling. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20.

However if you did not pay sales tax at the time of purchase you will need to pay the sales tax based on the actual amount paid for the vehicle There are exceptions and this is. Most states roll the sales tax into the monthly payment of the car lease though a few states require all the sales tax for all your lease payments up front. Vehicle value is taken into account by the personal property tax.

The leased vehicle will be titled in the name of the lessor owner. In a couple states such. VAT-registered companies can reclaim up to 100 of the tax on vehicle payments on a business lease and on any maintenance.

All applicable fees are due at the time of titling by the lessor such as the 15 title fee and the. Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. This means you only pay tax on the part of the car you lease not the entire value of the car.

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

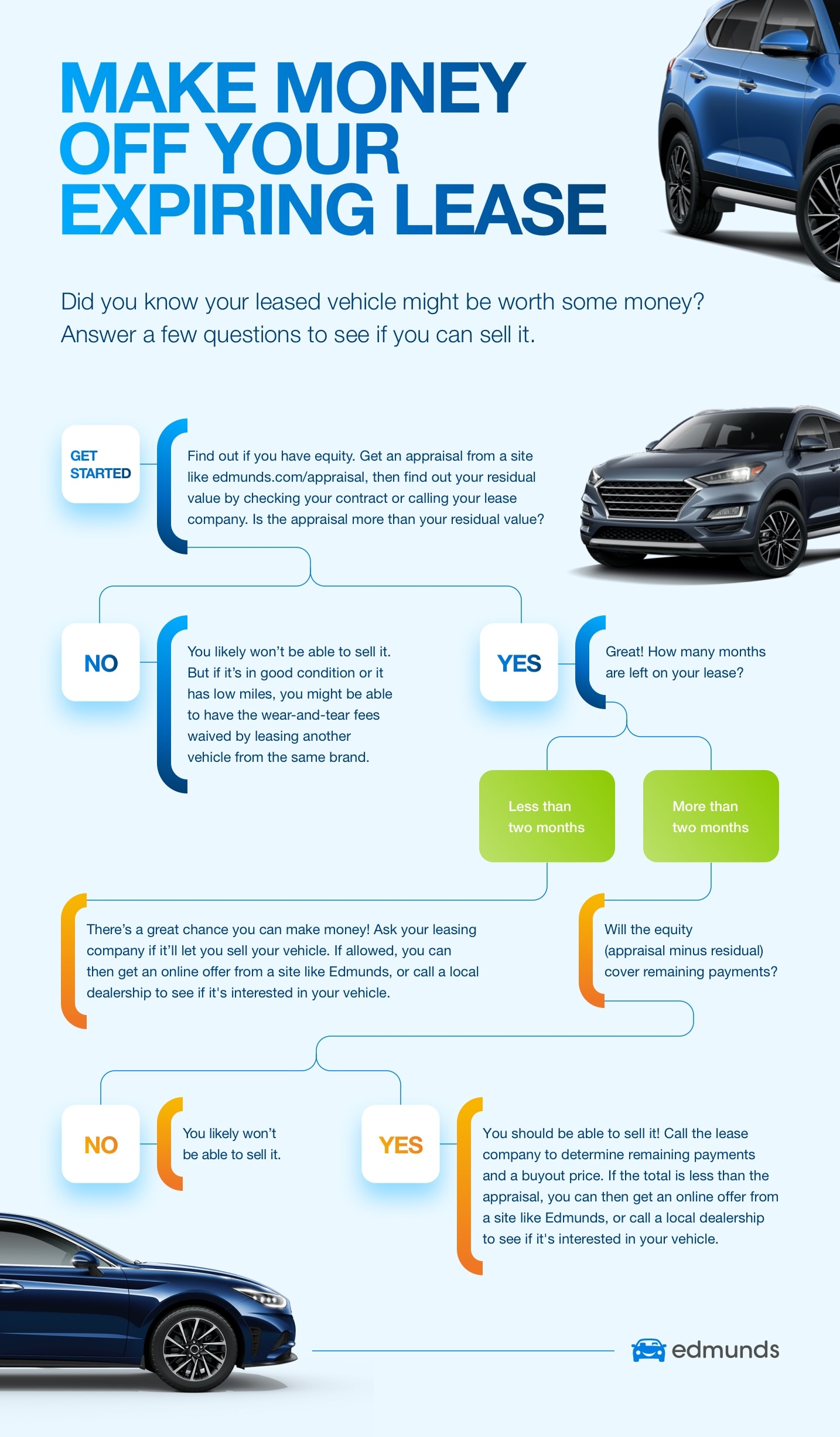

Consider Selling Your Car Before Your Lease Ends Edmunds

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Why You Need To Choose Bmw Lease Nj Option Bmw Lease Car Lease Lease

How Does Leasing A Car Work Earnest

How To Lease A Car Credit Karma

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Why Do You Need Gap Insurance Car Lease Insurance Gap

10 Money Saving Car Leasing Tips Car Lease Lease Saving Money

What Should I Expect When I Return My Leased Car Autotrader

Your 2019 Leased Car Could Now Be Worth 7 200 More Than Expected

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

Why Do People Car Lease Cars Car Lease Why Do People Lease Specials